What is taXchain

The system-independent platform “taXchain” helps you to lead your tax and customs function into the future. Therefore, the taXchain platform is constantly growing new use cases to digitalize tax and customs processes.

taXchain, which is based on the futureproof blockchain technology, eliminates paper-based processes while enabling cost savings, compliance, and transparency in your tax and customs processes. And on top of that, you can securely exchange data between companies with the assurance of its originality.

Don’t forget: Tax and customs requirements are not in competition, so join us and modernize your tax and customs administration with us.

At least, it is important for us to clarify that taXchain is embedded in a non-profit organization, designed to be system-neutral and to provide benefits to everyone (independent of the size of your company).

Why taXchain?

Trust via Blockchain

Single source of truth

Real-time information

Data Security

High standard of safety &

Two-factor authentification

Efficiency Gains

Speed

Analytics &

Transparency

System Neural Development

Non-system bounding &

Independent of developing companies

Digital

Removal of paper-

based processes

Cost Savings

Reduce operating costs in Tax

and customs while reducing

compliance risk

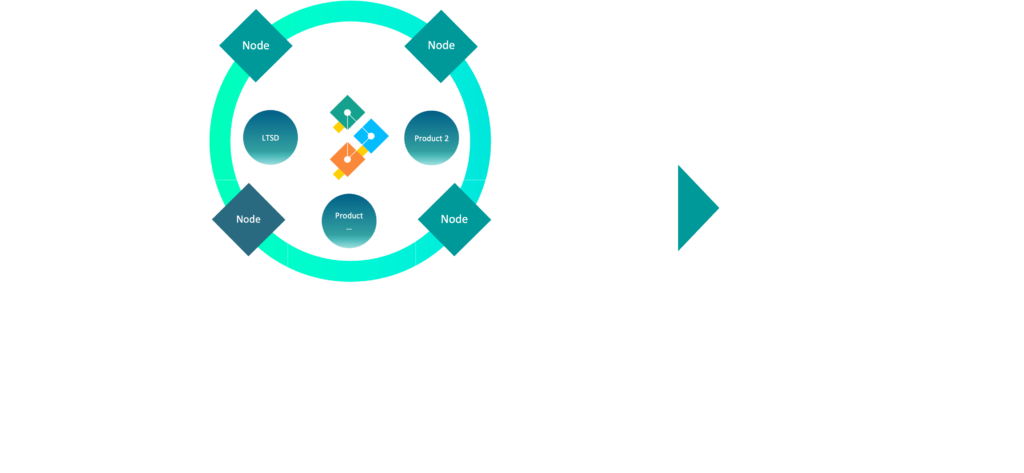

taXchain Collaboration Model

taXchain Platform

• Review via a Quality Gate

• Deployment and Upload on taXchain

• Data transfer and ID management are monitored here by the operator

• Payment of a license fee or membership fee for the use of individual tools (or the entire platform)

Siemens and Henkel

as taXchain pioneers

The initial partners of the taXchain association, Henkel and Siemens, have joined forces to develop use cases for the use of blockchain technology in the tax and customs function.

Initially, the first practical case was a joint blockchain application for the so-called long-term supplier’s declaration in the sense of Art. 62 UZK-IA in the customs area. Further use cases are to follow in the future.